Rehab, New Construction and Rental Property Lending in Connecticut

Get the money you need to succeed in real estate investing with New Construction, Fix and Flip (Bridge), and Rental Property Loans from Lend Some Money.

Connecticut Loan ApplicationInvestment Properties in Connecticut

If you're looking to make a real estate investment in Connecticut, you'll find plenty of opportunities. Connecticut is home to major companies. The top 10 largest companies in Connecticut are Glencore, Charter Communications, Amphenol, Otis Elevator Company, Stanley Black & Decker, Baker Hughes, Aetna, XPO Logistics, Henkel, and First Health Medical Group. Others are ESPN and the Naval Submarine Base in New London and Groton. Sikorsky and Yale New Haven are also major employers within Connecticut. Because of its geographical closeness to New York City, many areas of Connecticut are home to top companies making flipping homes or real estate investing a popular business opportunity.

The Nutmeg State, Connecticut is located in the northeastern United States and shares borders with Rhode Island, Massachusetts, and New York. Although one of the smallest states in terms of land area, it's the fourth most densely populated state in the country. The word “Connecticut” is derived from the Native American quinetucket, meaning “besides the long, tidal river.” The state is named after the Connecticut River which flows through its center and south to Long Island Sound. The capital of Connecticut is Hartford and other major cities include Stamford, New Haven, Bridgeport, and Waterbury. General fun facts about Connecticut include: it's home to the first pizza chain in America (Pizza Hut), the first Frisbee was invented here, and as of 2010 there were more millionaires per capita in Connecticut than in any other state. Finally, on August 22, 1902, Theodore Roosevelt became the first U.S. president to ride in an automobile while in office - he stopped in Hartford’s Pope Park and spoke to a gathering of about 10,000 workers.

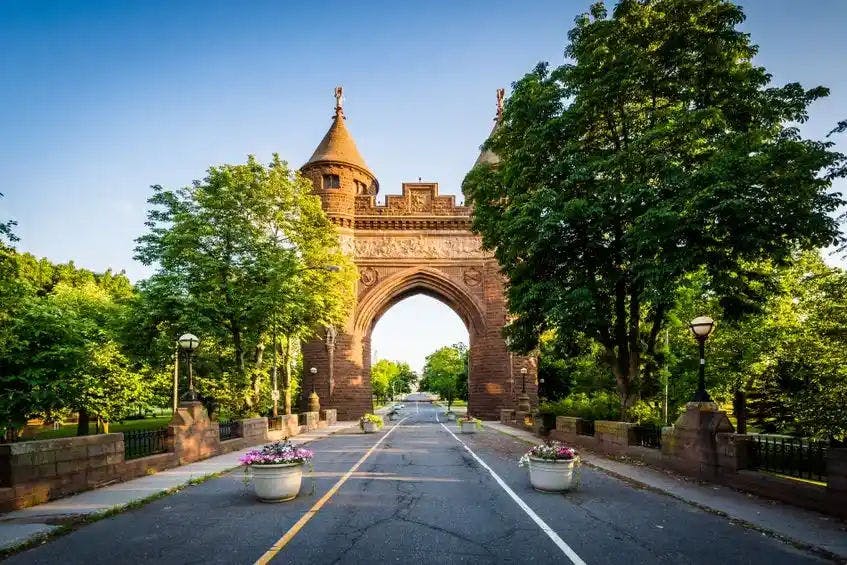

There are plenty of attractions in Connecticut worth checking out, too. Mystic Seaport and the Yale New Haven University are just two examples. The Glass House in New Canaan is also a popular tourist destination.

The median sale price for a house in Connecticut is $352,000, and the average rental price is $1,716. There are also 865 vacant land lots available for sale as of March 2026.

Demographically, 25 to 34-year-olds make up 13.3% of the population, while 35 to 44-year-olds make up 17.1%. 45 to 54-year-olds make up 37.0% of the population

If you're looking for investing opportunities, fix and flip properties, new construction, and rental units are a good option in Connecticut. With so much to offer, it's no wonder why Connecticut is a popular choice for real estate investors.

Apply with Lend Some Money today to kick start your investment opportunities.

The Nutmeg State, Connecticut is located in the northeastern United States and shares borders with Rhode Island, Massachusetts, and New York. Although one of the smallest states in terms of land area, it's the fourth most densely populated state in the country. The word “Connecticut” is derived from the Native American quinetucket, meaning “besides the long, tidal river.” The state is named after the Connecticut River which flows through its center and south to Long Island Sound. The capital of Connecticut is Hartford and other major cities include Stamford, New Haven, Bridgeport, and Waterbury. General fun facts about Connecticut include: it's home to the first pizza chain in America (Pizza Hut), the first Frisbee was invented here, and as of 2010 there were more millionaires per capita in Connecticut than in any other state. Finally, on August 22, 1902, Theodore Roosevelt became the first U.S. president to ride in an automobile while in office - he stopped in Hartford’s Pope Park and spoke to a gathering of about 10,000 workers.

There are plenty of attractions in Connecticut worth checking out, too. Mystic Seaport and the Yale New Haven University are just two examples. The Glass House in New Canaan is also a popular tourist destination.

The median sale price for a house in Connecticut is $352,000, and the average rental price is $1,716. There are also 865 vacant land lots available for sale as of March 2026.

Demographically, 25 to 34-year-olds make up 13.3% of the population, while 35 to 44-year-olds make up 17.1%. 45 to 54-year-olds make up 37.0% of the population

If you're looking for investing opportunities, fix and flip properties, new construction, and rental units are a good option in Connecticut. With so much to offer, it's no wonder why Connecticut is a popular choice for real estate investors.

Apply with Lend Some Money today to kick start your investment opportunities.

✓ Just a few of the locations we service - Norwich, Stamford, Danbury, Waterbury, New Haven, Hartford, Bridgeport

Connecticut

Loan Summary Information for Connecticut

Getting the right funding in Connecticut can be challenging but we can help; Lend Some Money (LSM) offers private money for real estate, built for your local investment needs in Connecticut. Whether you flip houses, or are interested in building a new home to sell, or a rental for the long term, LSM has a product that can help. We are one of the premier hard money lenders in Connecticut. Read on to learn more about our current offerings in Connecticut.

| Loan Products | FICO | $ Loan | Term | Rate | Points |

|---|---|---|---|---|---|

| FIX&FLIP (BRIDGE) | 620+ | $75K+ | 12-24 Mos | 10.25%+ | 2-4 |

| RENTAL (1-4) | 660+ | $75K+ | 30-Yrs | 7.59%+ | 1-4 |

| RENTAL (5+) | 680+ | $250K+ | 30-Yrs** | 7.89%+ | 2-5 |

| NEW CONSTRUCT | 650+ | $75K+ | 12-24 Mos | 10.89%+ | 2-4 |

All loans must be used for non-owner occupied properties purchased for investment. Commercial properties are not eligible for lending unless they are mixed use and comprise at least 50% residential use.

** 30 Years 5, 7, 10 or interest only